How to use Payroll feature of DRPU Employee Salary Software

Employee Salary Software is essential for various IT companies and business organizations to manage company records in simplified way. This software is useful for managing various records of employee like in-out detail, salary increment/decrement, payroll, day to day attendance, leave records and more information. Software allows generating and printing payroll pay slip of employee and manages payroll system. It provides advance option to create and managing company profile and facilitates to generate various company reports. ERP software is beneficial for many small and large business organizations to maintain multiple company records at one place in computerized manner.

Watch this video to learn how to use payroll feature of DRPU employee salary software

Company Employee Payroll Details Management ...

Now we have described how to use payroll feature of DRPU Employee Salary Software

Step 1: Install employee salary software on your Windows PC or Laptop for managing multiple company records.

Download DRPU Employee Planner Software

Step 2: Now open installed DRPU employee planner software, select Open An Existing Company option to manage your existing company records. Select your company and Enter Username and Password to for accessing your company details and click on login button.

Step 3: Go to Master menu and select Salary Parameter Setting option to adjust various salary attributes including over time details, any types of deduction from salary like provident fund, mess facility, half day charges, late coming or early leaving charges etc.

Step 4: You can access Tax and Allowance facility. Select Tax and Allowance setting from master menu and add or update tax information. You can also other allowance information like Bonus, Accommodation, Medical, Travelling and other as shown.

Step 5: Now select Pay-period used to calculate employee salary according to monthly, weekly and other time duration using Payroll Frequencies option from Master menu. You can enter pay slip number starts from detail and click on apply button.

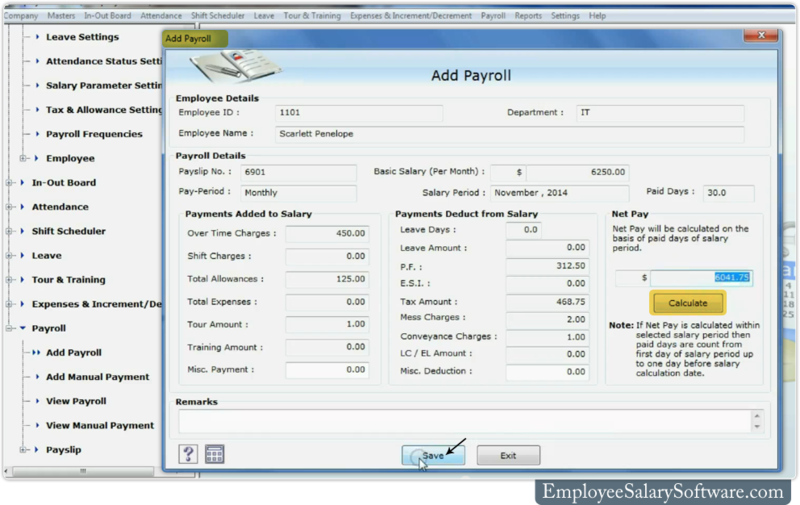

Step 6: For calculating company employee payroll, go to Payroll menu and select Add Payroll option to add payroll in selected employee. Now select employee ID and Pay-Period month as shown and click on OK button.

Step 7: Here you can see various Payroll information of selected employee. For calculating employee salary press Calculate button and save payroll record. You can manually add payment detail using Add Manual Payment option according to you.

Step 8: If you want to view payroll detail of employee, go to Payroll menu and select View Payroll option. Here you can see employee Payroll detail, you can also print employee payroll report using advance print option. You can also view manually payment record that entering by using manually process.

Step 9: For printing Payroll Payslip of employee, go to Payslip menu and select Payroll Payslip option. Select employee and double click on selected employee to view generated payroll pay slip of employee and press print option for printing report. You can also print manually generated payment pay slip.

Download DRPU Employee Planner Software

Contact us for more information:-

DRPU software team

Email: Support@EmployeeSalarySoftware.com

Website: www.EmployeeSalarySoftware.com